Most investors know that they should do some research before engaging the services of a financial advisor. The problem is they don't know how to do it. The good news is it's not a time-consuming task and if you follow some simple yet important steps, you will greatly reduce the chances of making a regrettable mistake.

Yelp Will Not Help

If you think you can search the customary social media sites for financial advisor testimonials, you'd be wrong. The reason is true investment advisors are bound by the Investment Adviser Act of 1940 and it specifically prohibits them from advertising using testimonials. They are not allowed to post any testimonials on their website, any site where they maintain control, or any publication. If a testimonial is found anywhere, the SEC will mandate that the advisor remove it promptly. In fact, if you see any testimonials on an advisor website or brochure, you can rest assured that you're dealing with a commissioned salesperson who is not an advisor at all - and you need to run away quickly.

Some argue that this rule hurts the consumer because it prevents them from getting the bulk of information and making a sound decision on their own. The SEC disagrees. It doesn't want the consumer swayed by testimonials, so it chooses to enforce the rule prohibiting them. Fortunately, you don't need to rely on testimonials to make an informed decision. There is another resource that is much more reliable.

The First Step - Checking Registration

One of the most important resources for any investor is FINRA. What is FINRA? FINRA is an independent, non-governmental regulator for all securities firms doing business with the public in the United States. They are authorized by Congress to be an investor watchdog, making sure the securities industry operates fairly and honestly. The information provided by FINRA is much more valuable than any testimonial, so it's the first place to start when vetting an advisor.

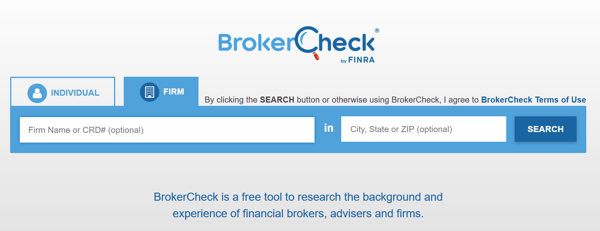

Once you know the name of the firm you're contemplating hiring, go straight to FINRA's website: http://brokercheck.finra.org

Type the name of the firm into FINRA's search tool and simply confirm that the firm exists and that it is properly registered as a securities licensed firm.

If you can't find the firm on FINRA's site, that is a warning sign. That means it's likely not registered with the SEC or state securities regulator and you need stay away from that firm. If a firm is not registered, then there is no oversight and you'll have little recourse as an investor if something goes wrong. Just do yourself a favor and don't hire any firm unless you can confirm that they are registered.

The Next Step - Avoid Firms That "Dual" Register

One of the dirtiest secrets in the financial services world is "dual registration". This is where a firm registers as an Investment Advisor and Broker simultaneously. Why is it such a big deal? Because an Investment Advisor is bound by a fiduciary obligation and a broker is not.

Imagine if your doctor also sold pharmaceuticals and every time she recommended a prescription it happened to be her brand that she recommended. How would you know that she is always prescribing in your best interest? You wouldn't and that's the point. That's the reason real doctors don't simultaneously sell their own brand of prescriptions - it's a conflict of interest.

But in the investment world this conflict of interest is allowed (while many argue that it shouldn't be). So, to protect yourself from basic conflicts of interest, you should never hire a firm that dual registers as an Investment Advisor and Broker. They should register as an Investment Advisor (IA) only, and not affiliate whatsoever with a Broker/Dealer.

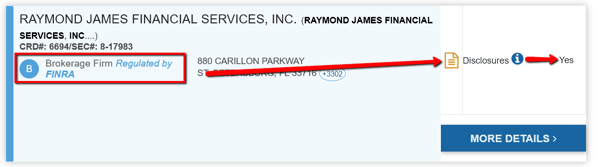

How do you know if a firm is "dual registered"? FINRA's BrokerCheck site will clearly identify firms that have a blatant conflict of interest. Here is an example of a dual registered firm:

By "dual registering", this firm is signalling that it is both a fiduciary and a sales firm. This is akin to trying to serve two masters. It's nearly impossible. The firm's salespeople are supposed to work in your best interest while at the same time sell you their proprietary financial products. This is nothing more than a financial high-wire act. Fortunately you don't have to stand for it. By simply eliminating the firms that dual register, you will actively distance yourself from the majority of conflicts of interest that perpetuate the investment community.

By "dual registering", this firm is signalling that it is both a fiduciary and a sales firm. This is akin to trying to serve two masters. It's nearly impossible. The firm's salespeople are supposed to work in your best interest while at the same time sell you their proprietary financial products. This is nothing more than a financial high-wire act. Fortunately you don't have to stand for it. By simply eliminating the firms that dual register, you will actively distance yourself from the majority of conflicts of interest that perpetuate the investment community.

Who Is The Big Bad Wolf?

So after you've confirmed that a firm is registered and that it's not affiliated whatsoever with a Broker/Dealer, the next step is to see if it's a bad actor. In the investment world, bad acts are classified as "disclosures". A firm that has disclosures is one that any investor needs to investigate more thoroughly before making a hiring decision.

How to Uncover Broker Firm "Disclosures"

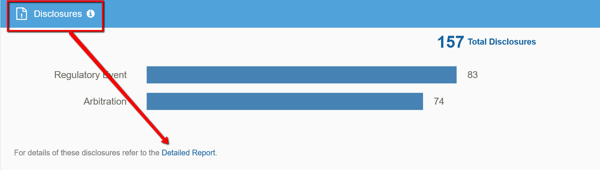

The steps to identifying Broker Firm disclosures is fairly straightforward. Simply access FINRA's BrokerCheck site and type in the firm name. The disclosures, if there are any, will be listed on the right hand side as such:

You can then drill down if you'd like and read the disclosure summary by clicking on the link:

Identifying Investment Advisor Disclosures ("Bad Acts")

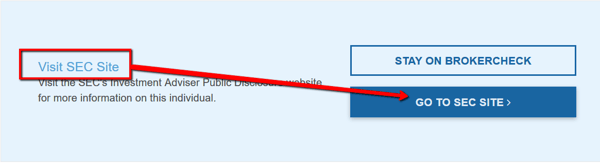

The steps to uncovering Investment Adviser firm disclosures are a little more complicated than for brokers, but nonetheless achievable. First, head over to FINRA's BrokerCheck site again and type in the name of the Investment Adviser firm you're researching. When you've identified the firm, click on its header and you'll see the following:

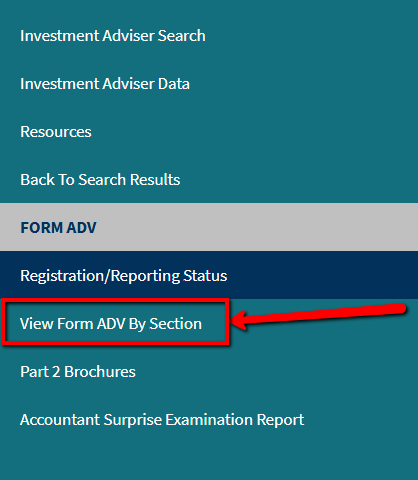

This link will take you directly to the firm's SEC's Investment Adviser page. Once you've arrived, click on the "View Form By ADV Section" Link:

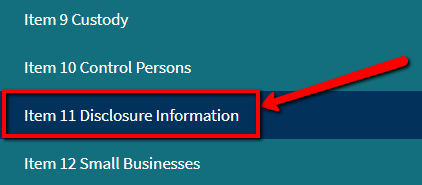

And then click on the "Disclosure Information" link

You will now have access to a complete summary of any disclosures or "bad acts" committed by the firm you're researching. If something sees ominous, then you'll need to research further or ask the firm to explain the circumstances regarding the disclosure. Either way, you'll learn valuable insight about the firm and how it has treated it customers and/or how well it has adhered to the SEC guidelines.

Summary

Vetting a financial advisor doesn't have to be a daunting task. By utilizing FINRA's BrokerCheck site and the SEC's Investment Adviser site, any investor can glean the information necessary to eliminate the firms that have an inherent conflict of interest or have acted in bad faith with respect to their clients.